Do You Hate Inefficiency? I Do.

Drowning in a sea of contradictory "expert" opinions?

Chasing meme stocks promoted by teenagers?

Interpreting chart squiggles like Rorschach tests?

NO! I don't have time for inefficiency. I certainly don't have time for emotion in markets. And I definitely don't have time to sift through the mountains of financial refuse hoping to stumble upon gold.

That's why I built The Stock Archeologist (TSA⛏️).

BEFORE (FORECAST)

AFTER (REAL PRICE ACTION)

Forget gut feelings. Forget that guru's "can't miss" tip. TSA⛏️ is my proprietary, systematic engine designed to do the heavy lifting.

It doesn't guess nor does it hope

It calculates and validates.

Here's what TSA⛏️ does:

Digs: Every day after the market closes, it systematically excavates data for the stocks that matter (specifically, the entire S&P 500 for my premium subscribers).

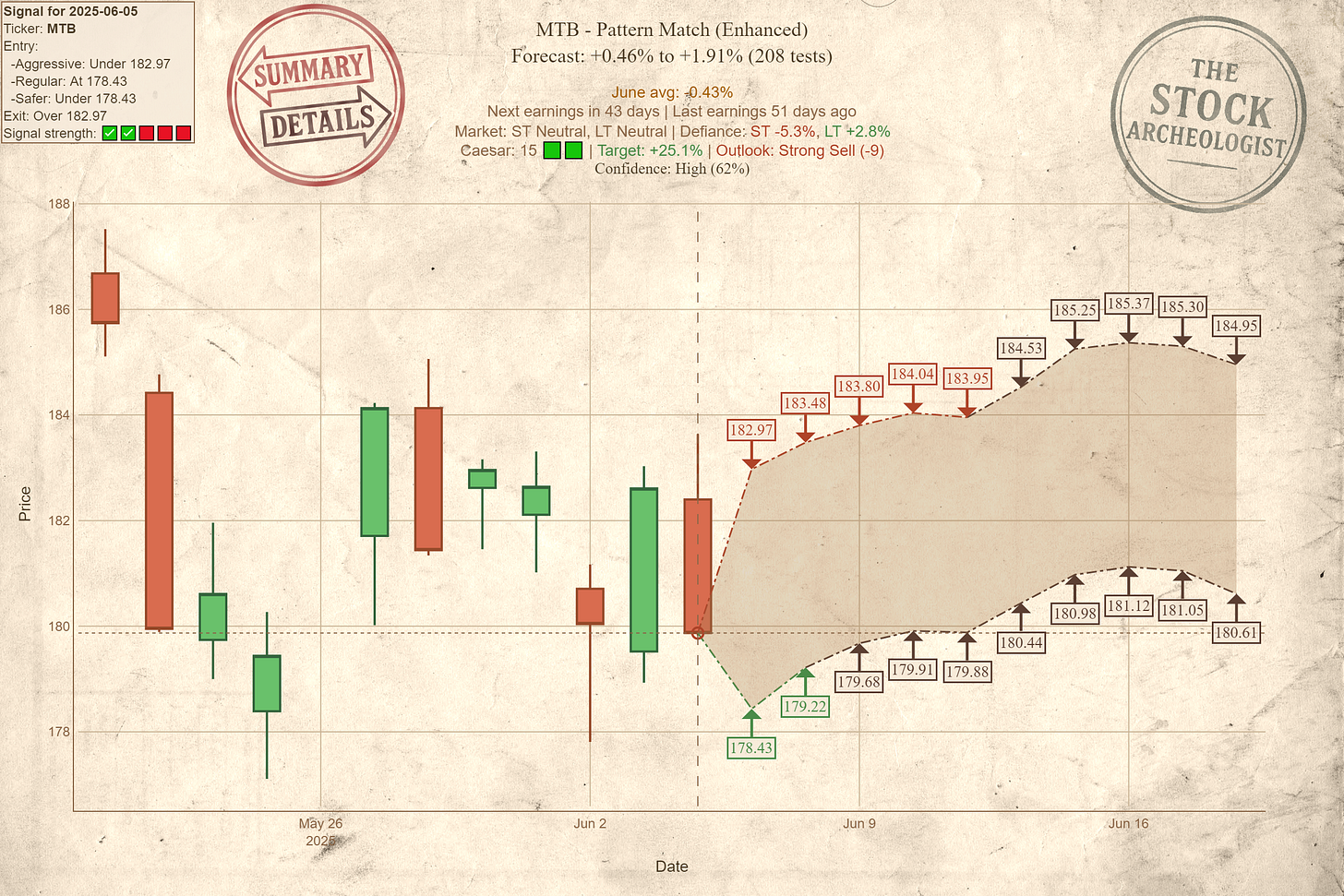

Applies Rigor: It runs a battery of my chosen indicators and proprietary checks – including the fundamental Caesar Score – to identify patterns and potential setups based on quantitative merit, not hype.

Consults History: This is non-negotiable. When a potential signal emerges, TSA⛏️ does so much more than just waving a flag. It travels back in time, finding every comparable historical instance for that specific stock and signal. How did it play out previously?

Projects Probabilities: Based on that historical deep-dive, it generates a data-driven projected price range for the next 10 trading days. Not like a quack herbalist. This is a researcher showcasing statistical Forecast based on history.

Filters Ruthlessly: I despise noise. Weak signals, low-probability historical outcomes, setups occurring near dangerous events like earnings – TSA⛏️ filters them based on strict performance and contextual thresholds. Only signals with a quantifiable edge even make it through and are projected as Forecasts.

Provides Context: Signals aren't presented in a vacuum. TSA⛏️ layers on crucial context: Overall market state (bull/bear?), the stock's relative strength (Market Defiance), seasonality trends, earnings proximity, fundamental quality (Caesar Score), and distills it all into a single Confidence Score. You instantly see the bigger picture.

BEFORE

AFTER

Why Subscribe?

Gain access to one free forecast a day (on a Telegram Channel) and see how past trades have gone. But let's be clear: the real engine runs behind the scenes.

For my Paid Subscribers:

You get direct access to the daily output of The Stock Archeologist's scan, run across the entire S&P 500.

Daily Signals: Receive the filtered, validated stock signals that meet my stringent criteria.

Dual Forecasts: Each signal includes projections from both the robust Default Mode and the adaptive Custom Mode, offering deeper perspective and sensitivity analysis.

Complete Context: Every signal comes with the full context report: Projected Range, Test Count, Market State, Market Defiance, Caesar Score, Earnings Proximity, Seasonality, Analyst Consensus overlay, and the crucial Confidence Score.

Convenient Delivery: Get these actionable insights delivered straight to you via a private Telegram channel or directly within the Substack Chat environment if you prefer to avoid another app.

Stop being market cannon fodder. Stop wasting precious hours wading through garbage. Stop trading on hope and hype.

My system was built for efficiency and probability enhancement. It brings discipline, historical perspective, and ruthless filtering to the table. It's the tool I wanted, so I built it.

If you want to leverage a systematic, data-driven approach and access the curated output of TSA⛏️ daily, the choice is obvious.

Hit subscribe. Choose the paid tier. Consider it an investment in reclaiming your time and potentially upgrading your results from "wet noodle gladiator" to something resembling competence. The cost of ignorance is far higher.

– Caesar